Individuals

Moving from Hong Kong to the UK: Financial Tips for BNOs (British Nationals Overseas)

Financial Tips for BNOs Relocating to the UK from Hong Kong

By Kanak Kandakumar, Assistant Vice President or Personal Insurance at Clements

If you’re a British National Overseas (BNO) planning to relocate to the UK from Hong Kong either alone or with your family, effective financial planning is one of the best ways to ensure a seamless journey to your new home overseas.

Here are some financial tips for the most important steps to take to be financially set up for your move to the United Kingdom.

Transfer Your Bank Funds

If you’re planning on moving soon, you’ll need to transfer your bank accounts to Britain and convert your currency into pounds sterling (known as GBP). The two main methods of accomplishing this are through your bank or through a money transfer company.

Whichever way you choose, the steps are the same.

Step 1: Register

First, you’ll need to go through a registration process. This will require some basic identifying information such as your driver’s license, passport number, or a utility bill. This registration process is required by financial regulations as a safeguard against money laundering.

Step 2: Secure an Exchange Rate

Exchange rates are constantly in flux. This means you’ll have to confirm the current exchange rate between the Hong Kong dollar (HK$) and pound sterling (GBP) with either a banker or a foreign exchange broker, depending on whether you’re using a bank or a money transfer company to send your funds to the UK.

Step 3: Send the Funds

Once you’ve completed the two steps above, you’ll send your funds to the institution of your choice, to be converted into pounds sterling and transferred for you.

Decide Whether to Sell, Keep, or Rent Out Your Current Home in Hong Kong

If you own real estate in Hong Kong, it’s important to decide exactly what you plan to do with it before you relocate. Your primary options are selling it, holding on to it, or renting it out to tenants. Here are a few things to ask yourself to help you decide.

What Does the Current Market Look Like?

When deciding whether to sell or rent out your home, or whether to just hold on to it as an investment, one of the first things to consider is the state of the housing market in your area. Is it a seller’s market or a buyer’s market?

In a seller’s market, housing demand exceeds supply, so your home is likely to sell quicker and for a higher price, meaning you would have more liquid capital to use for house hunting in the UK.

If the housing market in your area is unfavorable, it might also make sense to rent out your home for a year or two and then sell it when market conditions become better from a selling point of view.

But also keep in mind that the 300,000 Hong Kong citizens leaving for the UK might impact real estate valuations in both areas according to Business Insider.

How Much Maintenance is Your Home Likely to Need?

If you end up deciding to rent out your home, you need to seriously consider how much maintenance will realistically be required on your end. Is your home older and likely to need repairs more often? You’ll need to make sure that you have money set aside for those eventualities.

You’ll also need to invest in a property manager. As an international landlord in the UK with a tenant or tenants in Hong Kong, you won’t be able to address any needed repairs or tenant complaints in person, so this is a very important point.

Make Sure You Have the Proper Insurance

Finally, if you do decide to rent out your home, it’s very important to make sure you purchase both homeowners insurance and landlord insurance, so your home is protected against events such as fire, theft, and vandalism, but also potential damage from your tenants.

Assess Whether You Should Rent or Buy Your UK Property

Once you’ve decided what you’re going to do with your property in Hong Kong, you’ll need to figure out whether you’ll be renting or buying your property in the UK. Here are a few considerations.

How Certain Are You You’ll Be Staying Long-Term?

Renting might be the move to make because you’ll have the freedom and flexibility to relocate once your lease expires.

On the other hand, if you’re taking your family to the UK and planning to settle there indefinitely, it might make more sense to buy your home. There are other factors to consider though.

How Much Liquid Capital Do You Have Access To?

According to Hamptons International, it takes an average of 10 years for the average person to save enough to money to make a down payment on a home. The average home cost in the UK is £235,673, based on data from the Land Registry.

The average down payment in the UK last year was about 23%, according to data provided by Hamptons.co.uk. Do you have the liquidity required for home ownership? If not, renting while you build your savings can be a good option.

How Is the Housing Market in the Area You’re Moving To?

Just as it is key to consider market conditions when deciding whether to sell or rent out your current home, the same applies to deciding whether to rent or buy in your new home country.

A market favorable to home buying, known as a “buyer’s market”, consists of many available homes, but little interest from potential buyers. This will force people trying to sell their homes to drop their prices lower and lower to attract a buyer, so you’ll have access to deals you wouldn’t have found in a seller’s market.

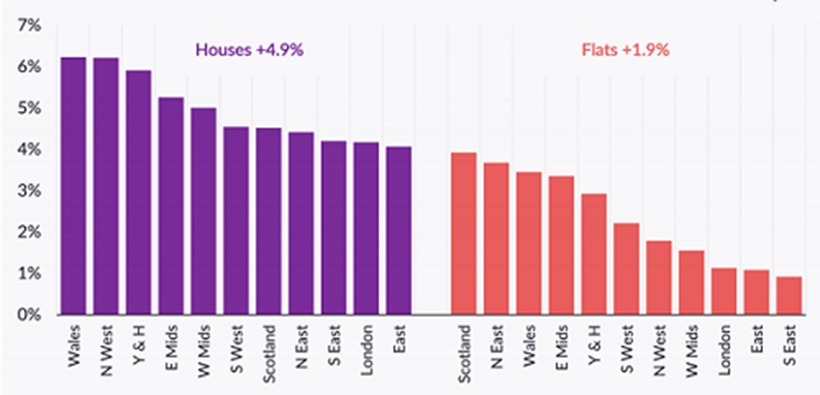

Currently, however, real estate valuations are rising in many parts of the UK. According to data from Hometrack.com, average prices are climbing for both houses and flats in many parts of the UK this year:

Spend time doing your own research so you can make the most informed decision regarding whether to rent or buy your home.

Know What Tax Changes Will Apply

As a BNO passport holder, you will be categorized as a “non-domiciled resident” of the UK. This classification simply means that you reside in the UK but have your permanent home elsewhere (in Hong Kong, in this case). Being a non-domiciled resident has important tax implications.

Arising Basis vs. Remittance Basis

UK taxes consist of two primary tax classifications. The first is known as taxation on an arising basis. This means that you will pay UK taxes on all worldwide income or capital gains, regardless of whether that capital is brought into the UK or not.

The other type of UK taxation is known as taxation on a remittance basis. A remittance in this context is defined as any foreign gains or income that you bring into the UK for your own benefit or that of a person significant to you.

If you choose to pay your UK taxes on a remittance basis, you will pay UK taxes on gains and income earned in the UK, but only pay UK taxes on foreign gains and income if they are remitted into the UK.

As a BNO, if your foreign income and gains are less than £2,000 annually, you can automatically file your UK taxes on the remittance basis.

Remittance Basis Charge

If your annual foreign gains and income exceed £2,000, you would typically have to pay a fee (the Remittance Basis Charge, or RBC) to pay your taxes on a remittance basis. But as a BNO, you will be able to file your taxes on a remittance basis for the first six years of your residence in the UK.

After your first six years residing there, the following applies:

- The RBC is £30,000 per year if you have resided in the UK for 7 out of the prior 9 years

- The RBC is £60,000 if you have resided in the UK for 12 out of the last 14 years

Get Proper Insurance

Protect Yourself, Your Property, and Your Family

One of the key things to prepare for your upcoming move to the UK is to make sure that you and your family have the proper insurance. You’ll want to ensure that you protect your valuables during transit, have proper car, property, and homeowners or contents insurance in place before you make your move with a customizable international personal insurance coverage.

Transit Insurance

Any time you relocate, it’s key to have your personal belongings protected by a transit insurance policy if they are damaged during the moving process.

This is especially true during an international move. Make sure that your transit insurance features:

- Coverage from your home in Hong Kong all the way to your new UK residence

- Protection whether your items are shipped via air, land, or sea

- Worldwide coverage for your international move

Ensure that your transit insurance policy features full coverage, which means that your insurance will go into effect even if just a portion of your items are damaged.

Personal Property Insurance

If you’re relocating to the UK soon, it’s very important to purchase coverage for your belongings. There are many potential perils that could damage your valuable items, and knowing you are financially protected will bring peace of mind.

Your personal property coverage will protect your items if they are:

- Damaged

- Lost

- Stolen

And make sure that your personal property insurance policy covers your home contents and personal items in the event of theft, vandalism, fire, and breakage.

UK Car Insurance

Your relocation also means that you’ll be needing appropriate car insurance in the UK. Car insurance is a legal requirement in the UK and so it is extremely important that you organise your car insurance prior to driving the vehicle on the road. Be sure to look for an insurer that provides comprehensive coverage, including third party liability. You can drive in the UK on an international licence for up to 12 months, at which point you will need to exchange your licence to a full UK driving licence and excess liability coverage.

Homeowners Insurance or Renters Insurance

Whether you’ll be renting in the UK or plan to buy a new home, you’ll want to be sure your residence is protected with homeowners or renters insurance.

Your homeowners insurance will cover:

- Dwelling: repair or replacement of your home or other structures on your property

- Personal possessions: have your personal belongings, like furniture, clothing, or appliances repaired or replaced

- Liability: protect yourself against accidental injuries or damage to someone else’s belongings while on your property

Homeowners and renters policies will help provide peace of mind for you and your family in the UK.

Transfer Your Business

If you own one of the 340,000 small-to-medium businesses in Hong Kong and will soon be relocating, you’ll need to make sure you’ve taken the necessary steps to transfer your business overseas and set yourself up for professional success in the UK.

Know the Relevant Regulations

The laws and regulations that govern businesses will be different in every country, meaning it’s key that you do the research to know which new regulations will come into play for your company overseas.

Make sure that you’ve educated yourself on Britain’s employment regulations pertaining to antitrust laws, email marketing, corporate advertising, human resources policies and more.

Research Your New Customers

If much of your business is locally based (meaning that you’ll have new target customers in the UK) get in touch with a marketing team or consultant who can conduct targeted research for you.

You’ll want to be sure to ask for key strategic answers about the needs, desires and tastes of your new customers.

Consult a Financial Expert About Exchange Rate Timing

When converting your business’s funds into pounds sterling, bear in mind that timing can make all the difference. You’ll want to be sure to get the advice of a financial expert or two on the best time to convert your company’s currency, if you have plans to do so.

Depending on the size and extent of your business, you may need international business insurance to provide specialized cover for our operations.

Have Any Insurance Questions?

If you’re a Hong Kong BNO considering moving to the UK, preparing financially is one of the most important things you can do to ensure you set yourself and your family up for a successful move and life in your new home.

If you have any questions about ensuring a seamless relocation, Clements Worldwide’s team of international insurance experts is here to help. To speak with an insurance advisor or have any of your inquiries answered, contact the Clements Worldwide London office at +44(0) 33 0099 0104. You may also email us at ukquotes@clements.com to get personalized quotes, or ukamendments@clements.com for general inquiries.

About the Author: Kanak Kandakumar is Assistant Vice President at Clements Worldwide and leads the global Personal Insurance division specializing in providing insurance solutions for expatriates around the world.