Individuals

Avoid Insurance Gaps During Your Permanent Change of Station (PCS)

Foreign Service members who are planning a permanent change of station (PCS) overseas often have many questions as they prepare for their relocation overseas. They and their families need support and guidance, especially with the more complicated aspects of their move, and finding the right international insurance coverage is one of them.

It can be difficult and time consuming to learn what type of insurance coverage is needed when undertaking a permanent change of station. Many people think the government, their international renters insurance, or their US homeowners or renters insurance policy protects them, but in reality, there are gaps in coverage that are important to know about to always be protected during your PCS.

The Foreign Service Institute’s Foreign Service Assignment Notebook recommends:

“Make certain you have adequate private insurance on your shipment and stored items for damage, loss, and replacement value.

Insurance Coverage Needs for Permanent Change of Station

Insurance is a very specialized field, and coverage needs for Foreign Service members are complex. Typical coverage is designed for those who live, work, and play in the US, but your needs are different as a Foreign Service member.

What Type of Coverage is Important?

Worldwide Auto Insurance

Covering you seamlessly while in your

- first country

- when in transit to your next post

- while in your next country

Borderless auto coverage regardless of where you are stationed in the world or when in transit back to the US. Many policies are location restricted, but a tailored worldwide car insurance policy designed for the Foreign Service needs follows you when you switch posts overseas.

International Household Effects Insurance

You need coverage for your personal property / belongings or renters insurance:

- while you are in transit via sea, air, or ground transportation

- household effects at your residence abroad

- belonging left behind in government or commercial storage

- Baggage during your international travels, including the US

The US government published the “It’s Your Move” guide which recommends you have transit and at-post coverage with the same carrier to avoid potential gaps in coverage or confusion between carriers as to who is responsible should a loss or damage occur. Their guide reads: “You are strongly encouraged to purchase private insurance to cover your effects.”

A household effects insurance policy created specifically for Foreign Service members changing stations can eliminate both gaps in coverage and any confusion between carriers regarding responsibility.

The US government’s guide recommends private insurance because:

- “The (government) claims program pays replacement cost minus depreciation in most cases. Thus, any item lost will be reimbursed at less than replacement cost.

- There are limits on reimbursement for certain items, such as expensive hobby equipment, jewelry, furs. Any value over these limits will have to be provided by commercial insurance.

- Private insurance will enable you to cover the cost of replacement should you sustain a loss.”

The government also notes, “The Military Personnel and Civilian Employees’ Claims Act of 1964 was not designed to serve as primary insurance – only as a backup mechanism.” This means, “It is strongly recommended that you arrange for private insurance covering loss, damage, and replacement value for your household effects (shipped and stored).”

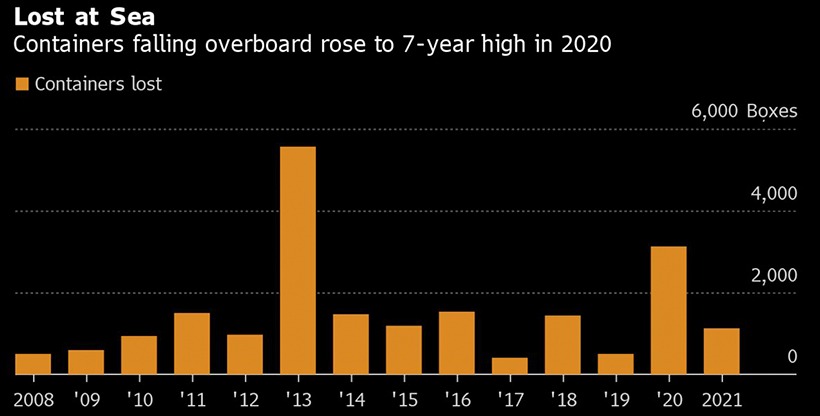

Cargo Loss at Sea Is on the Rise

Cargo loss in the ocean continues to be an issue that results in tens of millions of dollars in annual losses. An average of 1,382 containers are lost at sea each year, according to the World Shipping Council’s 2020 report.

The statistics below illustrate the severity of the problem. (Source: Bloomberg)

If these had been your items and they weren’t insured, you’d have no way of reclaiming the cost. The only way to make sure you’re protected from costly losses during your PCS is to purchase private insurance.

Benefits of a Policy Specifically Designed for Foreign Service Community

Since your coverage needs as a Foreign Service member undertaking a permanent change of station are different from many other domestic insurance customers, you need a policy designed with your needs in mind. Using an agency with expertise in crafting Foreign Service specific insurance solutions can help you save time and avoid expensive mistakes and doubts about your coverage. The peace of mind that comes from knowing your property is protected at all times is invaluable.

Specific Benefits

- Fills the potential gaps of government coverage – For example, the US government offers some protection if your car is damaged in transit, but only if it is lost or totaled (not scratched or dented). It can take a long time to get reimbursement, and you will need to file paperwork with the government. For these reasons, the US government recommends you secure private insurance for both in-transit and at-post times to ensure you are always protected. Choosing private insurance customized for your unique needs ensures peace of mind and, in the event of a loss, a smooth claims process.

- Political Violence – Cover is extended for damage to your car from perils like riots and terrorism. These hazards are not usually covered under a traditional insurance policy, but this valuable coverage was added in consideration of the unique needs of Foreign Service members.

- Full value replacement cost of household effects which provides much broader coverage. Replacement value provides a much higher replacement cost than Actual Cash Value.

- All-perils can cover damage or loss from things like in-transit scratching, marring, humidity, and mold. These additional perils can be very significant so having a more comprehensive policy can be invaluable.

- Uninterrupted coverage – With a policy designed for Foreign Service members’ needs, your household effects are protected at all times – whether it is in transit, in storage, on R&R, or abroad at your new post.

- This eliminates the usual gaps that are found in generic policies not designed for your needs.

- Uninterrupted coverage also means that you will not have to remember and track policy-in-force dates for different policies, which makes things easier and more convenient for you as the policyholder.

- Streamlined coverage – Transit coverage is on the policy for the whole term and automatically switches to covering your property at-post once it arrives. This simplifies your life as you won’t need to inform us of each step.

- You will, however, need to remove transit from the policy when it comes up for renewal if your property will not be transported elsewhere during that next annual term.

- Ease of purchase – Foreign Service insurance policies designed especially for Foreign Service members’ needs are the best solution to help make your insurance purchase easy and stress-free. Traditional policies may be the best bet for domestic use. Still, when going overseas and transitioning from post to post abroad, the coordination of your coverage is essential, and going through an insurance provider that has the knowledge and understanding of your needs will make things easier for you.

- Landlord insurance – Coverage for your US home is available if you are renting it while stationed overseas and for your property left at home while you are at post. This is helpful coverage to be sure your items left back at home are protected.

- Seamless coverage when moving back to the US – Insurance options is available when you are returning home and when going abroad, reducing any potential gap in coverage for your return trip.

Final Thoughts

When embarking on a permanent change of station, it’s important to have all of your insurance needs in place before your departure. With specialized insurance solutions for the Foreign Service community, you’ll avoid gaps in insurance coverage, and you’ll have peace of mind knowing that your items are always financially protected while in transit, at post, or back at home in the US.

Have Any Questions?

Clements Worldwide has provided the Foreign Service community with specialized insurance since 1947. We understand your specific needs for a PCS and can help arrange coverage when you are going abroad or returning to the US. The convenience of one agency handling all of your insurance needs will give you one less thing to worry about as you prepare to move overseas.

Contact us via this form, at info@clements.com, or call us at +1-800.872.0067 to speak to a dedicated account representative.

We look forward to contributing to the success of your next mission abroad.

Relevant Helpful Resources

Find tips, trends, and perspectives to help you confidently make decisions and navigate challenges internationally with peace of mind. Read how you can live, operate, and manage risks abroad.

An Expat’s One-Stop Guide to Driving in Ireland

Steering Through Spuds and Sheep: Tips for Driving, Requirements, Traffic Rules,

Tips for Driving in France: an Expat’s Guide

Driving in France is a great way to explore the country’s

12 Best Scenic Drives & Road Trips in the UK & Ireland

For expats in the United Kingdom or business travelers who wind