Organizations

How Does DBA Insurance Work? [with Infographic]

![How Does DBA Insurance Work? [with Infographic]](https://www.clements.com/wp-content/uploads/2019/03/how-dba-insurance-works-1-820x416.jpg)

Defense Base Act (DBA) insurance offers benefits for those employed in a U.S. government project located outside of the United States and provides coverage in the event they are injured or killed while involved in the project.

The benefits from DBA insurance vary depending on the job, situation, and type of coverage needed, but can range from disability compensation to covering medical expenses, or death benefits. The amount of compensation received depends on a variety of different factors, such as percentage of payroll, nationality, and the extent of the injury.

Our DBA insurance page explains more about what DBA is, when it is required, and what is covered. In this piece, we’ll be explaining more about the DBA market, and how the process of acquiring DBA insurance works.

How Does the DBA Market Work?

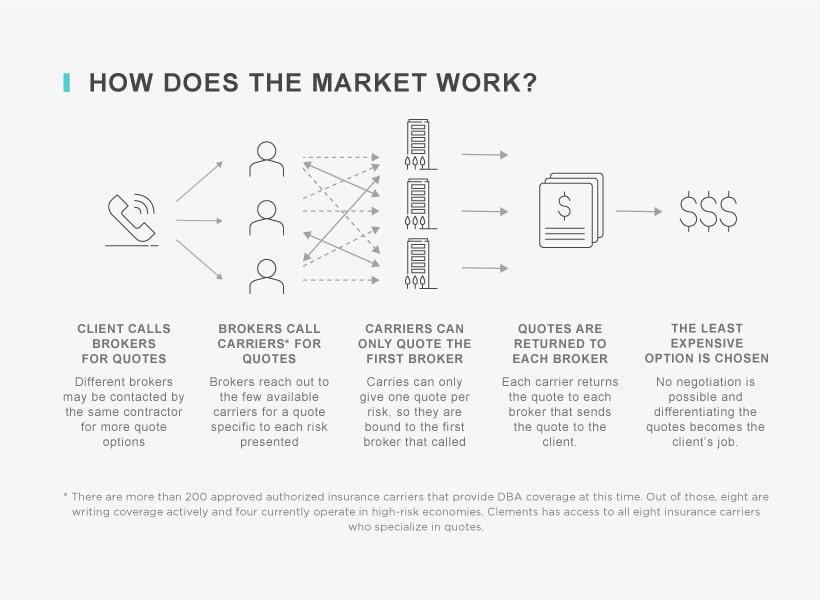

If you’re looking to acquire DBA insurance, there are two separate parties you’ll be directly and indirectly involved with. The first, and the one you’ll deal with primarily, is your DBA broker. Your DBA broker will be your point of contact and will get in touch with the second party, the carrier, on your behalf to secure the best quote. For those looking to secure insurance, the DBA market works as follows:

You Contact a Broker for Quotes

The first step is contacting a DBA insurance broker, such as Clements. You, the contractor, can contact multiple brokers for more quote options.

Your Broker Calls Carriers for Quotes

Once you’ve communicated your specific risks, your broker can take this information and reach out to the insurance carriers available for your needs.

Carriers Can Only Quote the First Broker They Speak To

Insurance carriers are only able to give one quote per risk, so they are bound to the first broker that called. This means, if you’re using multiple brokers, you’ll still only receive one quote from each carrier.

Quotes are Returned

Each carrier contacted then returns to the broker with their insurance quote, who then forward this selection of quotes to you.

At this point, you’ll have access to all the quotes available for your risk and can select the least expensive option or the policy best suited to your needs.

How Do You Get the Best DBA Quote?

The role of the broker is not just to source and present insurance quotes – we also negotiate on your behalf to ensure you’re left with the best quote possible for your needs. Here’s how to get the best value quote.

1. Contact One Broker

While you can contact more than one broker, as we explained above, each carrier can only supply one quote per risk – even if they are contacted by multiple brokers. This means using multiple brokers will not result in multiple quotes per carrier.

Since you now understand how the DBA market works, we’d recommend choosing one broker or DBA specialist with access to most markets to contact and source quotes on your behalf. This will ensure your broker has full visibility across the process and the range of quotes available, and can advise you effectively.

When you contact your broker, you should submit your proposal that defines your needs and estimated cost.

2. Provide Your Broker with Information

Once you’ve selected your broker, they will work with you to gather the information they need to source quotes on your behalf. The more information supplied, the smoother the process, so be ready to provide information pertaining to contracts, applications, salaries, employee concentration, and scope of work.

3. The Broker Calls All Carriers

When your broker has the information they need, they will then do all the work required to assure the correct risk is being quoted and there is no overpay. Your broker will contact carriers for you to present the risk to them and source their quote, so you don’t need to worry about dealing with multiple parties.

4. The Carrier Responds with Quotes

Some carriers may respond with an instant quote, however, there is also the option for carriers to follow up with questions or offer terms – or even decline altogether. This is why it is important your broker has as much information as possible relating to your risk.

5. Your Broker Compares Your Quotes

Once they have all the information they need, each carrier will then return to your broker with their best quote for your risk. Once the broker has received a quote, they can compare it to the quotes from other carriers.

6. Brokers Negotiate with Carriers

As the broker has full visibility on each quote available, they can then go back to each individual carrier and negotiate to get you the best price and coverage. At this point, some carriers may add in additional services such as employer liability coverage or risk mitigation coverage.

As mentioned, this saves you from having to source, compare, and negotiate multiple quotes – your broker does all this work on your behalf.

7. You End Up with the Best Quote Possible

At this endpoint, your broker has verified the risk and carried out the necessary negotiations with carriers. This means you are presented with only the best quotes, offering affordable coverage for your needs. You can then decide which carrier is the best fit for you.

Common Mistakes to Avoid

Don’t call multiple brokers

Calling multiple brokers can cause confusion for everyone, as you won’t have one single broker with full visibility over the process.

It also means you’re wasting your time dealing with multiple insurance brokers when you will end up with the same quote regardless.

Choose the correct broker

You will end up paying more out-of-pocket if you go with the wrong broker.

Using a DBA broker who does not have access to all carriers limits options.

Why Choose Clements as Your DBA Broker?

We would always recommend sticking with one DBA insurance broker to ensure your costs are kept to a minimum. So, why choose Clements?

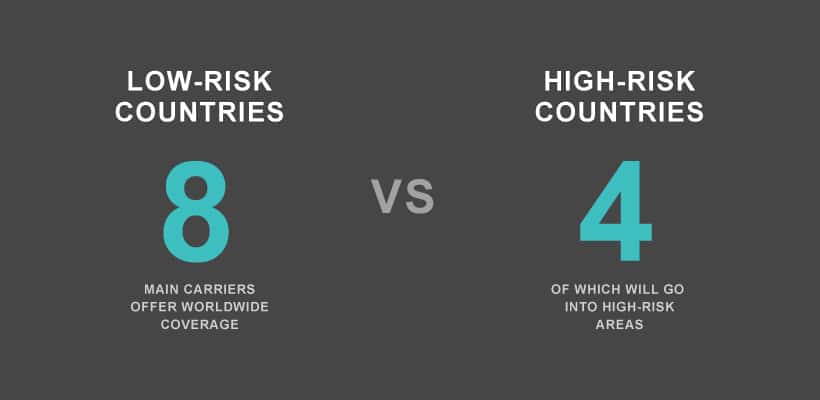

There are currently over 200 authorized insurance carriers providing DBA insurance coverage. Out of these, eight are writing coverage actively and four currently are operating in high-risk economies. At Clements, we have access to all eight insurance carriers who specialize in quotes, leaving us perfectly positioned to negotiate the best option for you.

For more information, or to get started with your consultation, just contact Clements Worldwide.

Learn more:

- DBA Insurance – Learn about the types of coverage, who is covered, limitations, and what else to think about to protect yourself.

- Why You Should Get a DBA Quote Before Bidding on a Government Contract – Did you know that many government agencies allow DBA to be a direct line on your proposal so you DO NOT need to pay it out of your overhead?

- What Does the Defense Base Act Cover for US Government Contractors?

- Separate Fact from Fiction: 9 DBA Insurance Myths to Debunk – Read about some of the most common misconceptions contractors have about DBA coverage.

- When DBA Coverage is Not Enough: International Group Personal Accident Insurance – Learn about the coverage gaps and how to protect your employees abroad 24/7.

- Types of International Insurance for Your Employees Working Abroad – Learn about how to select insurance depending on the type of work employees will be doing and where they are going.

Relevant Helpful Resources

Find tips, trends, and perspectives to help you confidently make decisions and navigate challenges internationally with peace of mind. Read how you can live, operate, and manage risks abroad.

International Group Personal Accident Insurance: When DBA Coverage is Not Enough

Created and reviewed by the Commercial Insurance and Underwriting experts at

Separate Fact from Fiction: 9 DBA Insurance Myths to Debunk

When researching DBA insurance, deciphering what’s true and what isn’t can

Achieving Effective Risk Management & Preparedness

Preparing for Risks with Confidence and Clarity Your organization serves with